Introducing BeeBribes, a product by Lavender.Five Nodes for the Berachain community that makes BGT bribery accesible, rewarding and fun.

Disclaimer (Update): Please note that some aspects of BeeBribes design have changed since Berachain's mainnet launch. We are now also introducing a BERA staking wrapper inside the app for a more streamlined user experience. We'll be publishing a comprehensive update blog soon with all the latest details and features.

Proof-of-Liquidity & Berachain

Berachain is best described as the Layer-1 that you would cook up if you have been in DeFi for years and are frustrated with the non-alignment between ecosystem builders and users. It is a blockchain and community that embraces, not just crypto culture, but also the incentive games that make web3 products so interesting and engaging.

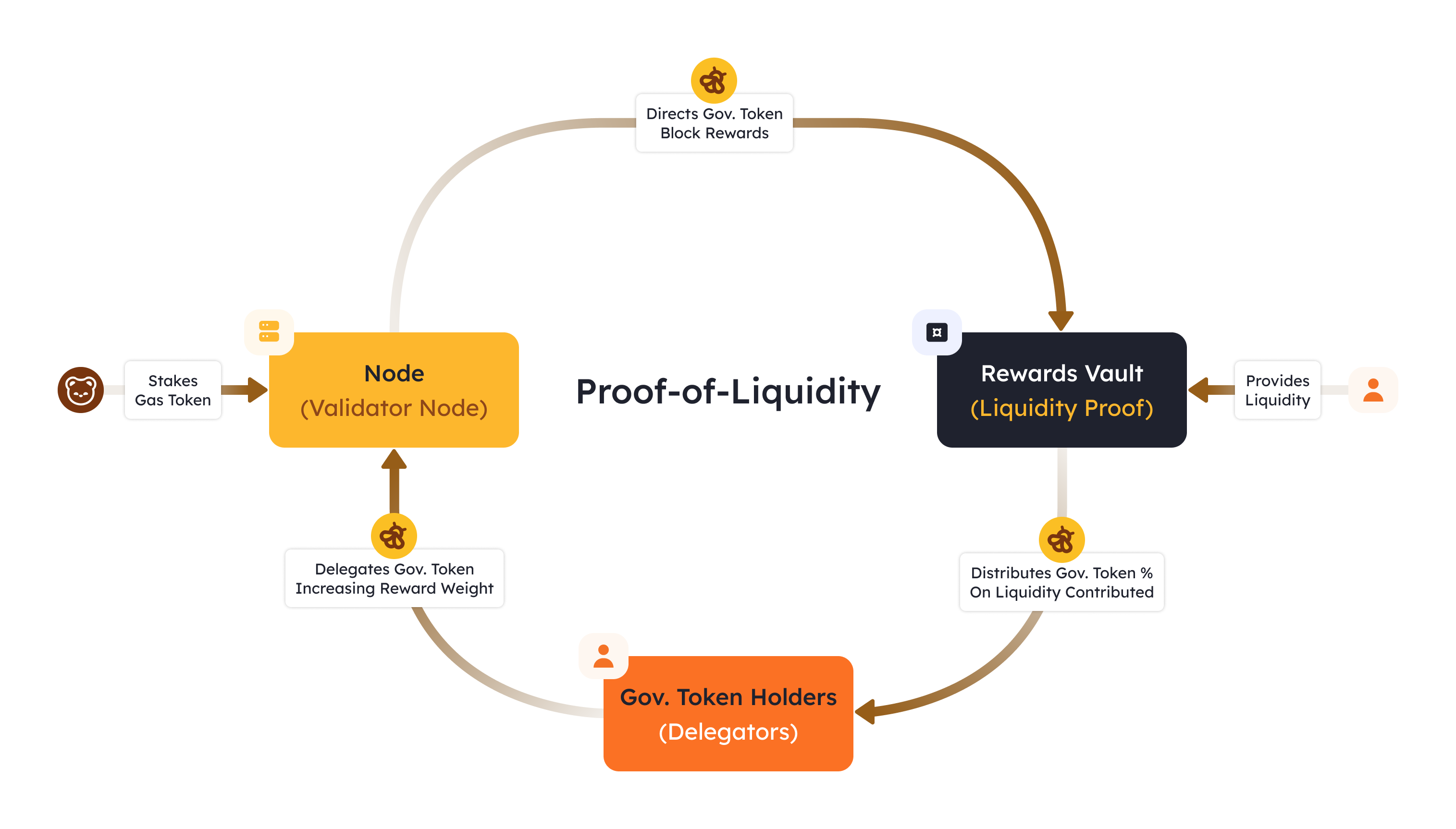

With it comes proof-of-liquidity, a new consensus scheme based on tendermint that overhauls "normal" Layer-1 tokenomics completely. Delegators stake BGT, a soul-bound governance token redeemable for BERA (the native liquid token) and with this voting power validators decide how to distribute block-rewards. Validators manage these block-rewards through a so-called cuttingboard whereby they choose which governance approved contracts like AMM pools, lending markets and so-forth receive BGT incentives.

It is widely expected that validators will be persuaded by delagtors and applications to manage their cuttingboard in so that their partners profit most. This type of on-chain bribery can be compared to the happenings during the curve wars. So far it seems like bribes happen mainly off-chain or through larger pooling contracts and LSDs like Infra-red finance. This is where Beebribes comes in!

Permissionless BGT Bribes

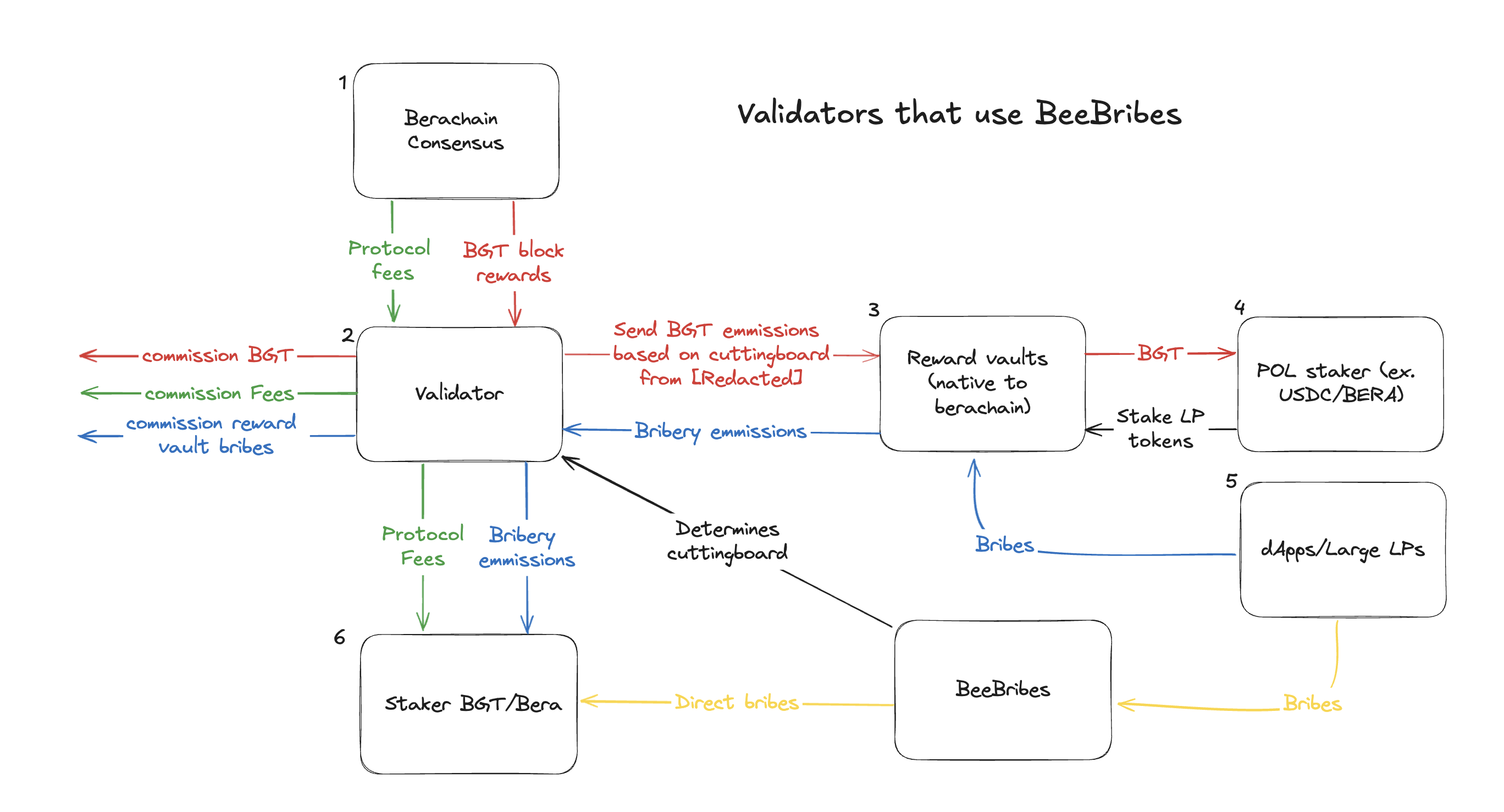

BeeBribes is a wrapper around a validators cuttingboard, initially only available for the Lavender.Five validator, that allows anyone to deposit bribes in return for directing a market weighted portion of the block-rewards from that validator to a specified rewards vault. Bribers (ex. large liquidity providers, application builders etc.) can deposit any token listed on BEX (with a minimum liqudity threshold) and bid on reward vaults that have been approved by governance to receive BGT emmissions. Delegators, who stake BGT (or BERA) with a validator, will receive any and all incentives paid by bribers for the validator to direct BGT to their chosen vaults. The total BGT emmitted to each contract is a simple function of the relative value that is committed to all reward vaults at the moment the cutting-board is changed (which is on a cooldown period of ~1 day). If there is only a single briber all block-rewards go to their choice of contract, if there are 2 bribers but one has provided 90% of the dollar value in incentives than 90% goes to their chosen contract and 10% to the rest. This mechanism effectively puts a price on BGT incentives and allows dApps, LPs and any other participant to steer the on-chain economy of berachain. Stakers to validators that enable beebribes are expected to earn a higher yield than other stakers which they can claim through the BeeBribes app. Stakers have to register to BeeBribes first so there is an expected dispersion between active and inactive stakers.

dApp & Contract Design

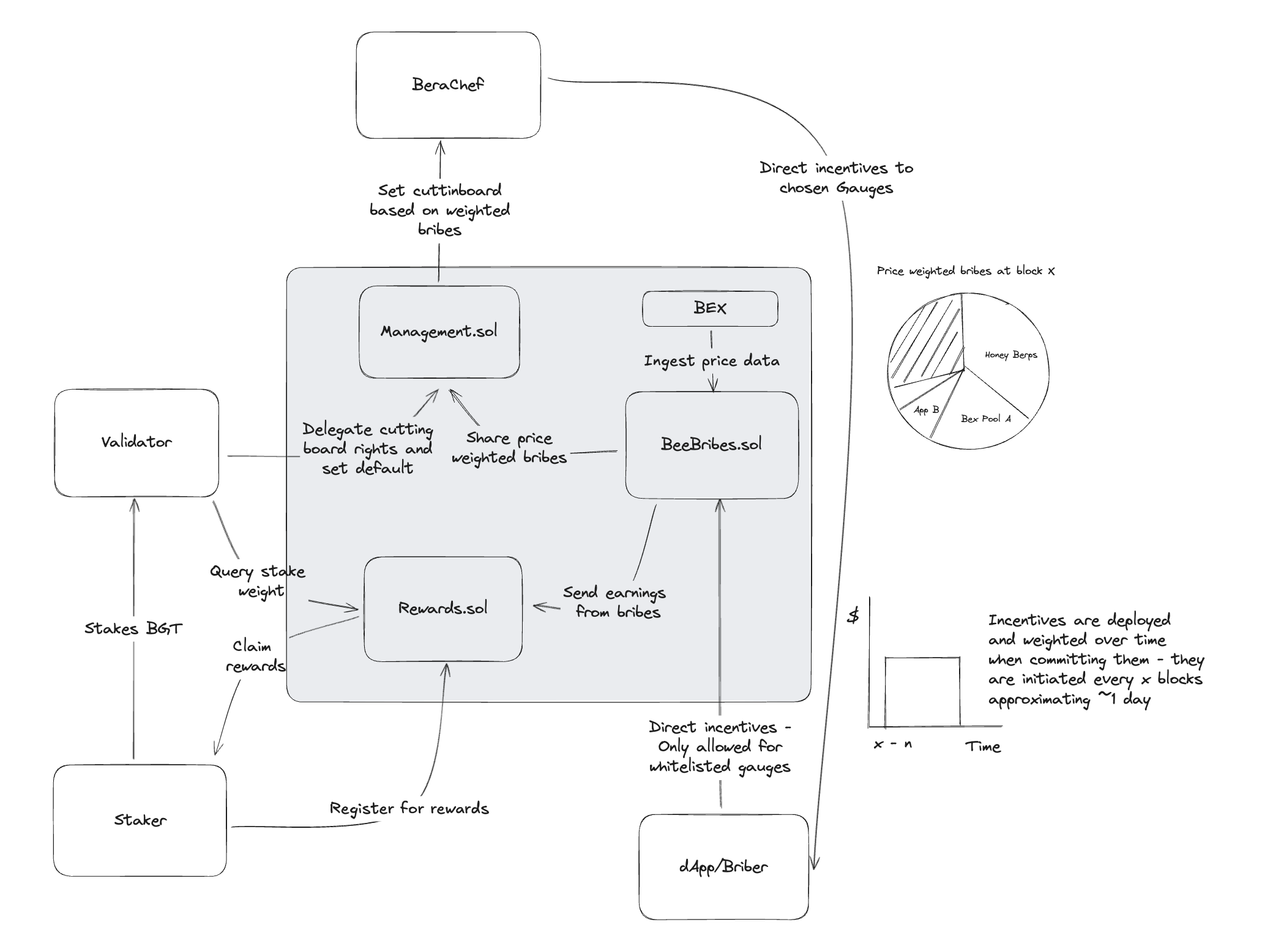

BeeBribes plugs directly into the BGT, BGTStaker and berachef contracts on Berachain. On setup the BeeBribes contract gets controlling rights to a validators cuttingboard using the setOperator function, the app assumes the validator to behave honestly and not change the cuttingboard without involving BeeBribes. The validator can control how much of their cuttingboard they want to steer through the BeeBribes app by setting a default distribution and any percentage they want to steer to a specific reward vault.

BeeBribes opens an auction every day known as the epoch, within that epoch it collects bids from bribers for the right to direct a portion of the validators BGT incentives. The auction runs up to a few thousand blocks before the epoch end at which removing bids is no longer possible and the contract will look to execute the auction. It compiles a cuttingboard by computing the total weight of every vault using $HONEY as the denominator through the BEX on-chain prices at that moment in time. After execution the cuttingboard is put into action the next time a validator proposes a block and the BGT incentives will start flowing to the winning reward vaults. All bribes are send to a rewards contract where stakers can claim them based on their voting-power to the specific validator so that every BGT staked gets the same amount of rewards. All incentives that come through the Berachain reward-vault system can be claimed by stakers just like if they were not opting in to Bee-ing bribed.

Features & Thoughts

- Stakers get both native BGT yield and any additional yield from bribes in the tokens chosen by the briber.

- BeeBribes accepts Bribes in more tokens than just the whitelisted reward tokens per vault and also accepts an unlimited amount of bribers.

- BeeBribes dynamically prices BGT incentives based on the market value.

- BeeBribes makes bribery instant and direct, there is no need to wait for validators to migrate their incentives to your reward vault based on the yield dispersion.

- Bribers can post bids for many epochs into the future or manage it day by day, only spending on incentives when the market price is right.

- BeeBribes should be considered as wholly additional yield if you follow the efficient-market-hypothesis. As all validators optimize their cuttingboard around the existing reward vault incentives there should be ~0% dispersion in yield on just these vaults. This means stakers to BeeBribed validators earn the same yield as if they were not using BeeBribes but get additional bribes from the permissionless auction system. This assumes BeeBribes itself will never get large enough to influence the efficient market.

- A cuttingboard is only able to choose a maximum of 10 reward vaults, any vault thereafter in-size will see all bids refunded.

- Stakers must register to BeeBribes before they can start earning rewards so to limit the centralisation risk on the operator as the addresses delegated to the validator is unknown to the EVM.

- Validators can choose the percentage of their cuttingboard they want to steer through BeeBribes and can change this at any time.

- Bribes can only bid in a whitelisted set of tokens to limit liquidity risk on calculation of the auction and avoid unfair pricing.

- Bribers can bid until the end of the epoch but only cancel their bids until ~2 hours before closing to avoid griefing.

- There is both a minimum Bribe and a Minimum BGT stake requirement to prevent spam and abuse.

- Lavender.Five Nodes is currently the only supported validator as we explore PMF and bring a potential version 2 live live where all validators can use BeeBribes. We are also the admin of the BeeBribes contract which will be open-sourced under a BSL license when mainnet goes live. Lavender.Five takes no fees from the BeeBribes system.

We are super thrilled to bring BeeBribes to market for all delegators and validators out there. Thank you for reading - The Lavender.Five Nodes team.